Pre-payment meters

What is a pre-payment meter?

If you have a gas or electricity connection, your home will have a meter to keep track of how much you use. There are several different kinds of meter. With a pre-payment meter, you buy gas or electricity credit up front. With other kinds of meters, you use the energy first, then get a bill for it later.

You can think of pre-payment meters like the washing machines at a laundrette. You put coins or tokens in the washing machine. The washing machine runs for a certain amount of time. When your credit runs out, you need to add more coins or tokens so that it keeps working.

The first pre-payment meters did actually use coins and tokens. Nowadays, nearly all pre-payment meters have a special card or key. You put credit on your card or key at a shop, then transfer it to your pre-payment meter.

The pre-payment meter will have a slot for your top-up card or key. It will also tell you how much credit you have left, as well as information about the standing charge and any energy debt that you have.

On this page

Should you get a pre-payment meter?

Having a pre-payment meter means you only ever pay for the energy you use. There are no bills at the end of the month, and therefore no nasty surprises about how much you need to pay. However, there are number of things to think about before switching to a pre-payment meter:

Buying energy upfront rather than paying a bill at the end of the month usually works out more expensive. Some suppliers don’t offer pre-payment tariffs, whilst those that do only offer a limited range. As a result, it’s harder to shop around for the best deal.

Once you’ve spent the balance on your card or key, you won’t be able to use any more energy until you top up again. If your gas credit has run out, then anything that’s using gas will stop working. Likewise, if you’re out of electricity credit, then anything that’s using electricity will switch off.

Many suppliers offer emergency credit as a buffer. This means there’ll be a small amount of credit you can use if you’ve run out. However, the emergency credit will need to be paid back. It will be taken off your credit the next time you top up. For example, if you’re topping up £20 and you’ve used £5 emergency credit, you’ll be left with £15 credit on the meter after topping up.

Unless you have a smart pre-payment meter, you’ll need to take your gas card and electricity key to a shop to top them up. You can top up at a Post Office, or anywhere you see the PayPoint or PayZone logo:

You should check that you have a top up point which is easily accessible. Also, you’ll need to be careful not to run out of credit when your PayPoint is closed.

Find your nearest Pay Point location

Find your nearest Pay Zone location

You can ask your supplier for emergency credit if you run out whilst the shops are closed. This is known as friendly credit. Remember though, you’ll need to pay this back the next time you top up.

You won’t run into this out-of-hours problem if you have a smart pre-payment meter. A smart pre-payment meter allows you to top up at any time. You can add money to the meter through an app on your smartphone or computer.

With billed energy use, usually it’s possible to spread the cost of energy evenly throughout the year. For example, a supplier might calculate that a household will use £2,500 of energy this year. In general, most of that money will be spent in the winter months, when the heating is on. The supplier could split that £2,500 into equal monthly bills of £208.

Let’s look at what might happen if the same household was on a pre-payment meter.

In spring and summer, they would likely be topping up less. For example, they might only be spending £100 a month. This is less than half the amount they’d have paid for their monthly bill.

However, in the colder months they would be topping up much more. As shown above, over spring and summer the household spent £600 (£100 a month) on topping up. If the household uses £2,500 over the year, then through autumn and winter they’re going to use almost £2,000 worth of energy. As a result, they’ll be topping up around £333 a month.

You can avoid spending a large amount on topping up in winter by building up credit in the warmer months. However, this does require some forward planning and budgeting, so it’s worth considering this when thinking about switching to a pre-payment meter.

Running out of energy and not being able to top up can be quite serious for people with certain health issues.

We wouldn’t recommend choosing a pre-payment meter if:

- You rely on electricity to run medical equipment.

- Someone in your household is disabled or has a long-term health condition.

- There are young or elderly people in the home.

You might also want to think about whether health issues would make it difficult for you to:

- Visit a top-up point

- Access the meter itself

How do you use a pre-payment meter?

Both gas and electricity pre-payment meters work in the same way. The major difference is that your electricity pre-payment meter is topped up with a key, whilst your gas meter is topped up with a card.

To add credit to your pre-payment meter:

- Firstly, take your key and/or card to a shop for topping up.

- Next, tell the shop assistant how much credit you want to add. You can only add whole pounds, e.g. £5 or £6, but not £5.50.

- Next, put the topped-up key or card back in your meter to transfer the credit to your meter.

- Finally, take the key or card out again and store it somewhere safe.

Your meter should have a button which lets you access different screens. These screens include information such as:

- How much the meter will take each week for the standing charge and any debt repayment.

- How much emergency credit you have left.

- If you have any energy debt.

How can you owe money on a pre-payment meter?

Even though you buy credit upfront, you can still owe money on a pre-payment meter. This is because most pre-payment meters offer emergency credit and friendly credit.

Emergency credit and friendly credit mean that you can keep using gas and/or electricity when there’s no money on the meter. This works a lot like an overdraft on a bank account. You can spend more money than you have in your account, but it will need to be paid back.

Like paying off an overdraft, the next time you top up your pre-payment meter, some of that credit will go towards paying off the emergency and/or friendly credit you’ve used.

For example:

Say you’ve used £5 emergency credit and £2 friendly credit. If you top up £10, then £7 will go towards paying off the money you owe. This means that of that £10 top up, £3 will end up as credit on your meter.

If most of your credit is going towards clearing the money you owe on your pre-payment meter, then you should contact your energy supplier. Once you’ve made contact, they can work out a repayment plan. This might involve only taking part of what you owe each time you top up, not the full amount. Alternatively, pre-payment meter debt can be paid off through regular card, cash or cheque payments.

To get help sorting out a repayment plan, check out our guide for speaking to your energy supplier.

Can you be forced onto a pre-payment meter?

If you are in fuel debt, then some energy suppliers might want to switch you to a pre-payment meter.

Pre-payment meters should only be installed as a last resort. Legally, your supplier has to look at all the other options first. Once they’ve looked at all the options with you, they still need a warrant to come into your home and install a pre-payment meter.

There are certain situations where your supplier isn’t allowed to put in a pre-payment meter, even if all the other options have been looked at. For a full list of these and more information about your rights regarding pre-payment meters, see our Know your rights guide.

There have been reports of energy suppliers not following pre-payment meter rules for customers with smart meters. Energy suppliers don’t need to access your home to switch a smart meter to a smart pre-payment meter; they can do this remotely using a computer instead.

However, by law they must still look at all other options before making this switch. Ofgem, the energy sector regulator, are currently investigating these cases.

If your energy supplier has switched you to a pre-payment meter against your wishes, then have a look at our Speaking to your energy supplier if you can’t afford your energy bills guide. This will help you negotiate a repayment plan. Additionally, it also explains how to make a complaint about your energy supplier.

How to change from a pre-payment meter to direct debit

To change from a pre-payment meter to direct debit payments, you’ll usually need to get a new meter put in. This is the case for all types of energy payments which involve getting a bill rather than topping up.

If you have a smart pre-payment meter, then you won’t need to have a new meter put in when switching to direct debit payment. This is because most smart meters can be switched between pre-payment and billed modes by your energy supplier.

To change from a pre-payment meter to direct debit (or any other type of billing) you should contact your energy supplier. Ask your energy supplier to:

- Switch you over to a smart or conventional meter. Your supplier isn’t allowed to charge you for this.

- Help you get set up with a new tariff.

Moving to a home with pre-payment meters

If your new home has a pre-payment meter, then the advice below will get you up and running as quickly as possible.

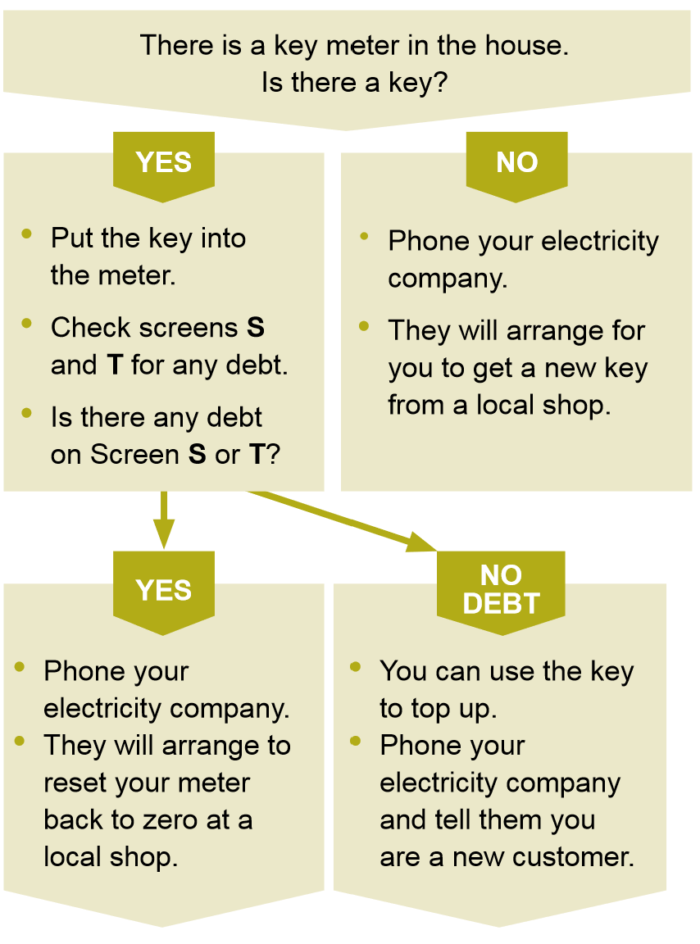

For an electricity meter:

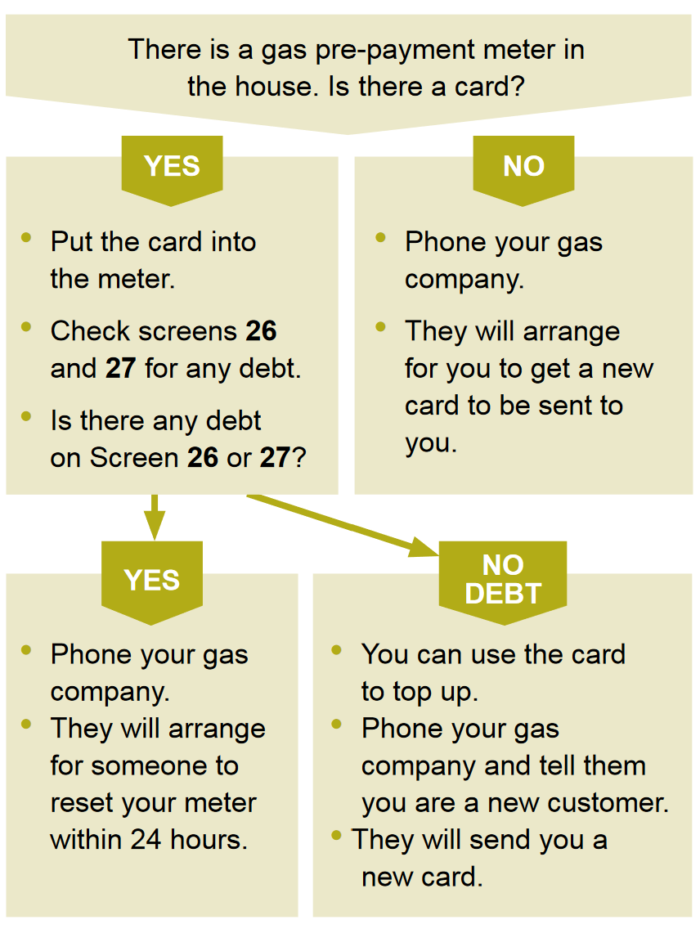

For a gas meter:

How to read a pre-payment meter

You pay for your energy upfront with a pre-payment meter. As a result, you don’t need to send regular meter readings to your energy supplier. However, if you do need to take a meter reading, just follow the steps below.

There are lots of different types of pre-payment meter out there. If the advice below doesn’t work for your meter, contact your energy supplier to ask how to take a reading.

If your gas pre-payment meter has two display windows, then the meter reading should be in one of the windows. Look for a number that’s followed by “m3”. Ignore any numbers after the decimal point.

If your gas pre-payment meter only has one display window:

- Firstly, Press the red “A2 button to turn on the display.

- Next, press the red “A” button twice.

- This should show a “Meter Index” screen. This is the meter reading.

- You can ignore any numbers after the decimal point.

You’ll need to move through a few screens on the meter to find the reading.

- Firstly, press the blue button to turn on the display.

- Next, press the blue button to move through screens. Look for a screen that has a number followed by “kWh”.

- If you pay different rates for electricity (a day rate and a night rate), these will be on separate screens. The first screen should say “rate 1”. The next screen should say “rate 2”.

- You can ignore any numbers after the decimal point.

How you read your smart pre-payment meter will depend on the type of smart meter you have.

Citizens Advice have put together a couple of excellent guides to help: